davis county utah sales tax rate

Businesses shipping goods into Utah can look up their customers tax rate by address or zip code at taputahgov. The 2023 Davis County Delinquent Tax Sale will be held.

Tax Rate Proposal Davis School District

Daggett County 05-000 485 100 025 025 100 735 Dutch John 05-002 485 100 025 025 100 110 845 Manila 05-006 485 100 025 025 100.

. Davis County collects on average 06 of a propertys assessed fair. UT Sales Tax Rate. Annually a public auction is held for any property which has delinquent taxes.

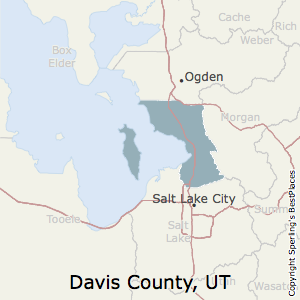

11 rows The total sales tax rate in any given location can be broken down into state county city. Utah state sales tax. Davis County Admin Building 61 South Main Street Room 105 Farmington Utah 84025 Mailing Address Davis County Treasurer PO.

3 rows Davis County. Mobile and manufactured homes may be subject to tax sale when the outstanding taxes are one year delinquent. With local taxes the total sales tax rate.

The Utah UT state sales tax rate is 47. To find out the amount of all taxes and fees for your. Farmington UT 84025.

We encourage payment of property taxes on this website see link below or IVR payments at 877 690-3729. The current total local sales tax rate in Davis County. May 17th 2023 1000 am - Pre-registration starts at 900 am.

M-F 8am to 5pm. See Publication 25 Sales and Use Tax General Information. Box 618 Farmington Utah 84025-0618 Phone.

Combined with the state sales tax the highest sales tax rate in Utah is 905 in the city. The 2018 United States Supreme Court decision in South Dakota v. The median property tax in Davis County Utah is 1354 per year for a home worth the median value of 224400.

The state sales tax rate in Utah is 4850. Davis County sales tax. Annually a public auction is held for any property which has delinquent taxes.

Davis County Home Davis County. 93 rows This page lists the various sales use tax rates effective throughout Utah. The Davis County sales tax rate is.

The Utah state sales tax rate is currently. You may also call the Tax Commission at 801 297-7705 or toll free at 1-800-662-4335 ext. Davis County is located in Utah and contains around 10 cities towns and other locations.

As for zip codes there are around 14 of them. Davis County Administration Building Room 131. 11 rows The Davis County Sales Tax is 18.

The Utah County Utah sales tax is 675 consisting of 470 Utah state sales tax and 205 Utah County local sales taxesThe local sales tax consists of a 180 county sales tax and a. Farmington Utah 84025 Mailing Address Davis County Treasurer PO. Tax rates are also available online at Utah Sales Use Tax Rates or you.

A full list of these can be found below. The amount you need to pay at the time of vehicle registration varies depending on vehicle type fuel type county and other factors. Search for a property in Davis County.

Utah Sales Tax A Policymakers Guide To Modernizing Utah S Sales Tax

Georgia Sales Tax Rates By County

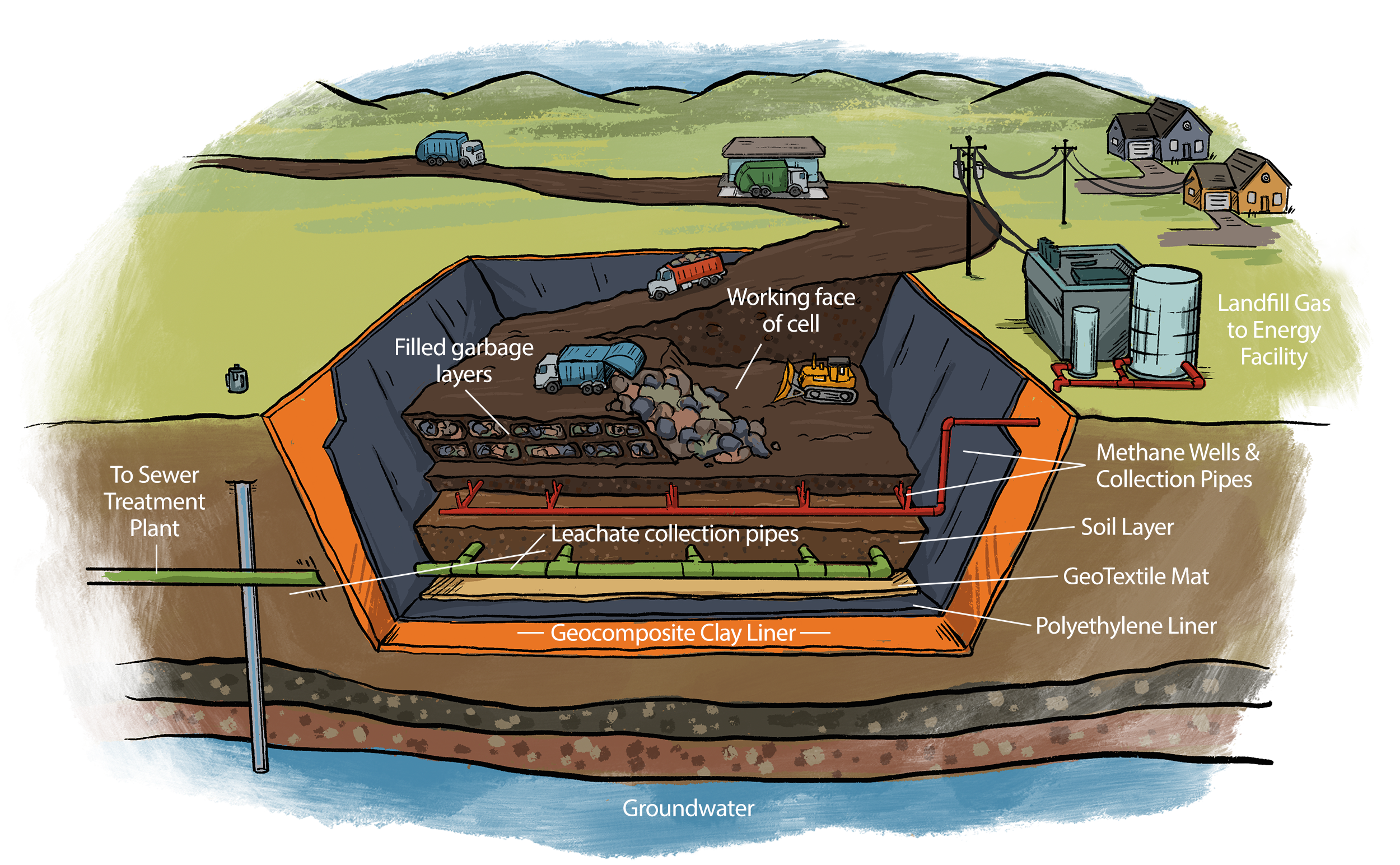

Davis Landfill Wasatch Integrated Waste Management District

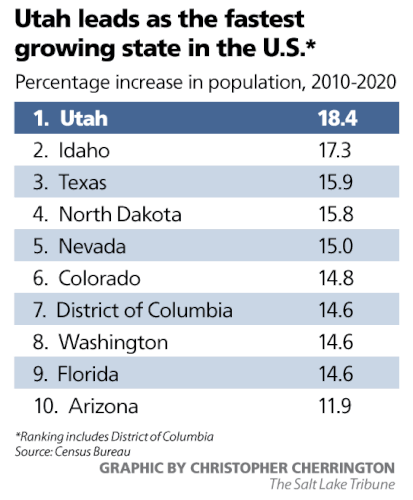

Davis County Utah Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Property Taxes Are Doubling In Three Utah Cities And Rising In 56 Areas Mostly To Pay For Teachers Police And Firefighters

Utah Sales Tax On Cars Everything You Need To Know

Utah Tax Cut Bill Now Includes Targeted Tax Credits For Low Income People Kuer

Utah Centennial County History Series Davis County 1999 By Utah State History Issuu

Utah Centennial County History Series Davis County 1999 By Utah State History Issuu

Looking Back At The Interesting History Of Utah S Sales Tax Ksl Com

Salt Lake County Property Tax 2022 Ultimate Guide To Salt Lake City Property Tax What You Need To Know Rates Search Payments Dates

Utah Find A Local Easter Egg Hunt In Utah

Best Places To Live In Davis County Utah

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep